When it comes to protecting your home and belongings, having the right insurance is only part of the equation. The way you organise your house insurance details – including a thorough home inventory – can have a big impact on how much you pay, how fast claims are processed, and how well you’re covered when disaster strikes.

At Life Possum we believe that taking control of your insurance records can save you money and time. So here’s a quick guide on what to do and why it can save you time and money:

Accurately Assess Your Insurance Coverage Needs

Most homeowners underestimate the value of their belongings. A recent NFU mutual survey found that just 21% of homeowners knew exactly how much it would cost to replace their possessions with 13% admitting to having no clue.

Without a detailed inventory and details of your most treasured assets you can easily forget to include your most valued possessions; according to AXA the top 5 things we forget to add to our insurance policies include:

- Laptops and devices

- Wedding/Engagement rings

- Watches

- Inherited items, especially antiques, artwork and jewelry

- Designer handbags

By documenting these items – with photos, receipts, and descriptions – you’ll be better equipped to choose the right level of home insurance coverage. This helps avoid being underinsured if you ever need to make a claim.

And don’t forget to make sure your house itself is properly insured. Recent surveys estimate that over 70% of UK buildings aren’t adequately insured (the so called reinstatement cost). To get an idea of how much your reinstatement cost should be try the BCIS calculator to give you an idea.

Keep Your Policy Information Handy

It’s not just your inventory that needs organising – keeping track of your insurance documents is equally important.

Make sure you know:

- Your policy number

- The name of your insurer

- The renewal date

- Your excess and coverage limits

- Any optional extras you’ve paid for (like accidental damage)

Having these details in one place means you’re not scrambling when you need to contact your insurer – whether to make a claim, ask a question, or update your details. It also makes it easier to spot when your policy needs a refresh, or when something has been removed or added without your knowledge.

Keeping a record of what you’re paying and when your policy renews can also help you take back control of your finances – especially if your premiums have crept up quietly over the years.

Shop Smart at Renewal Time

When renewal time comes around, it’s easy to stick with your current provider – especially if you don’t have all the details to hand. But this can cost you.

Using comparison sites like MoneySuperMarket or Compare the Market can help you see if you’re getting a good deal. Having a clear view of your current premium, level of cover, and inventory helps you compare like-for-like – and avoid paying more for less.

Insurers sometimes offer their best deals to new customers, so don’t be afraid to switch if you find a better fit. And if you prefer to stay loyal, use your research as a bargaining chip – many providers will match or beat competitor quotes to keep your business.

Avoid Overpaying for Outdated Cover

As your life changes, so do your possessions. If you’ve sold, donated, or downsized some of your belongings, your current policy might be covering things you no longer own.

By regularly updating your home inventory, you can ensure your policy reflects your current needs – and avoid overpaying for unnecessary cover.

Unlock Better Home Insurance Deals

A well-organised inventory doesn’t just protect you – it can save you money.

Some insurance providers offer better rates or tailored policies if you can show that you’ve taken steps to document your property thoroughly. This is especially helpful if you qualify for high-value home insurance that standard policies may not cover.

Having a structured list of possessions makes it easier to compare quotes, negotiate premiums, and spot exclusions or limits in the cover offered.

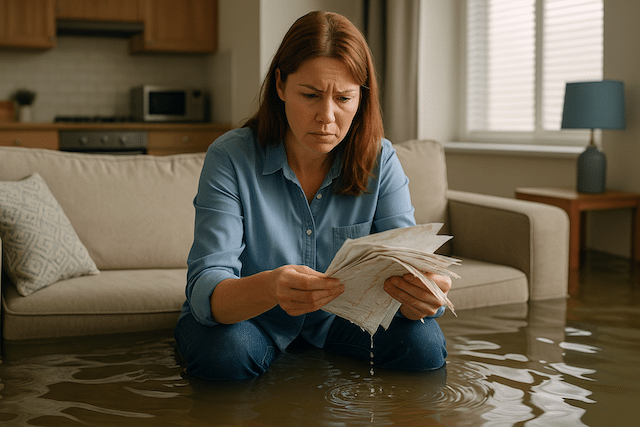

Speed Up and Strengthen Insurance Claims

If your home is damaged or items are stolen, a detailed inventory becomes your best ally. It can:

- ✅ Prove ownership

- ✅ Support the value of your belongings

- ✅ Help you recall everything that’s lost or damaged

- ✅ Speed up the processing of your claim

In many cases, insurers will settle faster – and more fairly – when you have indisputable proof of what you owned and its condition.

Ensure You Recover the Full Value of Your Losses

A rushed or incomplete claim can leave you short-changed.

With an up-to-date, itemised list – including photos and supporting documents – you’re more likely to recover the full value of lost or damaged property. This is especially true for rare or expensive items that might otherwise be missed or undervalued.

Know When You Need Specialised Coverage

Many standard policies have caps on individual items. For example, valuables like fine jewellery or original artwork might only be covered up to a few thousand pounds – unless you’ve arranged specific coverage.

By documenting high-value assets separately, you’ll know when to request itemised cover, ensuring they’re protected properly.

How Life Possum Helps You Stay Organised

Managing all this information might sound like a headache – but it doesn’t have to be.

Life Possum makes it easy to record, update, and manage your home inventory, valuable assets and insurance details, all in one secure place.

With Life Possum, you can:

- Create digital inventories of items by room

- Upload photos and documents for each item

- Track high-value assets for each person in your home

- Keep track of your insurance policy details

- Access and update your data from anywhere, any time

Life Possum Tip 💡

Make future you proud.

The best tip we can give? As always, add a little information as you go! Just add items as you make purchases to keep your assets and inventory up to date.

Organising your home insurance details isn’t just about being tidy – it’s about being proactive, and prepared. It can mean the difference between a smooth insurance claim and a stressful financial loss.

Take the first step today. Start to store your inventories with Life Possum and enjoy the peace of mind that comes with knowing your homes and everything in them are fully protected.

Ready to start? Log in to your Life Possum account and start updating your details today.